The Mekorma Guide to Accounts Payable Success

Contents

- 1.) Introduction to the Accounts Payable Process – Past, Present and Future

- 2.) Who is this Guide for?

- 3.) Accounts Payable Challenges

- 4.) How Do You Effectively Manage Accounts Payable?

- 5.) Old School AP vs. AP Automation in the Age of Digital Transformation

- 6.) How to Measure AP Success

- 7.) How to Evaluate Accounts Payable Software

- 8.) Mekorma’s AP Automation Software Suite

- 9.) Case Study

Introduction to the Accounts Payable Process – Past, Present and Future

Accounts Payable (AP) has been around for a very long time – for as long as humans have been doing business, trading commodities, and selling property. In fact, the very first written records in human history were developed to keep track of debts – on stone tablets!

.png?Status=Master&sfvrsn=42755095_14/AdobeStock_199601054-(Small))

Accounts Payable refers to the process of paying invoices and other debts that a business owes to its suppliers and creditors. Effective management of AP can help your business improve cash flow, form strong vendor relationships, and reduce the risk of errors or fraud.

AP has gotten decidedly more complex over the millennia – and we’re living during a time of radical shifts in how we process data and payments. Robotic process automation, machine learning, artificial intelligence…these and other emerging technologies are pushing financial functions into a new era.

As a modern financial team, you may find yourself somewhere between stone tablets and a fully automated payables process - walking the path of ‘Digital Transformation.’ It’s no small feat and calls for more than changing ERP or software solutions – people must be willing to think and work in new ways that ultimately lead to more ease.

This guide aims to share the general landscape of AP challenges and opportunities for growth – it is infused with Mekorma’s unique perspective, gained from 30+ years of experience working with small to medium businesses.

Who is this Guide for?

This guide is for financial professionals – CFOs, controllers, accounting supervisors or managers, and Accounts Payable specialists; or any business executive curious and motivated to learn about current best practices and ways to modernize the AP function so your organization can thrive.

Accounts Payable Challenges

Accounts Payable departments of today are responsible for far more than “just” paying the bills. Depending on your company’s size, industry and staffing, the challenges you face throughout the invoice to pay cycle will vary.

Common challenges include:

- Invoice management: receiving and approving invoices effectively can be a sore spot for many AP teams – especially if your process is still primarily paper-based, or if your company is growing and the volume of invoices increases without supportive systems. Three-way matching adds additional complexity that must be managed.

- Paying vendors on time and accurately: Paying vendors on time is critical to the success of your organization. If the AP workflow is overly manual or there are administrative bottlenecks along the way, it can be very difficult to accomplish. Late or inaccurate payments reduce trust and make vendors reluctant to work with your business.

- Too much paper!: Whether you’re handling invoices, payments, purchase orders, or expense reports, we still hear from AP professionals that they’re drowning in paper. When documents are not digitized as part of your daily workflow, paper piles up - and that means payment delays, errors, and disorganized record-keeping.

- Controls and risk management: Fraud can come from any direction, and the AP department is a common target for both internal & external attempts. AP teams have to implement policies and procedures that defend the organization’s cash.

- Maintaining positive vendor relationships: Vendors are core partners in the health of your company. In most cases, there is no business without your suppliers. Paying on time and being transparent with your vendors keeps the relationship healthy and solidifies your reputation as a trustworthy organization.

- Keeping up with changing rules and regulations: The IRS (USA) and other regulatory bodies create tax and compliance standards that businesses must adhere to. The rules are always changing, and finance teams have to stay educated about what’s required. Incorrect reporting can cost your business in the form of additional fees or penalties.

- Retaining or hiring knowledgeable staff: In the past several years, staffing the AP department has been a challenge. AP experts have retired or left due to burnout, and younger professionals do not want to work for businesses that won’t invest in modernizing the AP function.

- Technology – too much, too little, or lack of integration: Using the proper accounting system and AP software can solve many of AP’s challenges – but sometime the tech you have is part of the problem. Lack of effective AP software tools, or too many systems that don’t work together can slow down the payables process.

These are some of the top challenges we see our customers struggle with:

| Small-medium sized business (SMB) | Rapid growth organizations |

|---|---|

| Legacy systems: Budget constraints do not allow for process improvements, automation initiatives, or ERP / upgrades / optimization. AP staff is stuck with older software or systems. | Legacy systems: There is a pressing need for new technology or systems to accommodate growth. New solutions may be chosen without complete evaluation, which can lead to failed or botched implementations. |

| Fraud: Separation of duties or other internal controls may not possible due to small staff size. | Fraud: As you grow, there is an increased need to define and enforce compliance/regulatory. |

| Staff: Smaller AP teams are often overburdened with too much work – and manual work at that. | Staff: Increased workload means making staffing decisions – hire more people, automate processes, or outsource AP functions? Or some combination thereof? |

| Resources: Smaller teams often make do with “the way we’ve always done it.” Company leaders often don’t see any value in investing in AP improvements. | Resources: AP is often last on the list for essential digital transformation efforts, even when the company has streamlined processes in other areas. |

| Compliance: Smaller businesses often think regulatory agencies will not pay attention to them. However, being audited is typically a question of when not if. | Compliance: As your business grows, compliance issues become more complex, and you must devote resources to stay current with governmental regulations. |

| Payment Types: Many smaller companies continue to rely on check payments as the primary way of paying vendors. As remote work gains traction, this slows down the payment cycle and makes AP teams less efficient. | Payment Types: As a company grows and devotes more resources to streamlining operations, electronic payment types become an obvious choice for vendor payments. Transitioning to ACH or other electronic methods can be a heavy lift for AP teams. |

How Do You Effectively Manage Accounts Payable?

At Mekorma, we believe challenges are opportunities to do things a better way. This could mean redesigning processes or implementing new ones, automating, outsourcing, and hiring or re-skilling AP staff.

- Honest Assessment

- Look at how you do things, or “how you’ve always done it” and ask why.

- Growth Mindset

- Recognize that improvement means change, and change can be difficult; but it’s within reach to learn new ways and new skills.

- Coordination & Cooperation Between Stakeholders

- All stakeholders must be part of the conversation – the insight and voices of C-level, IT, Accounting Supervisors/Managers, and the staff who perform daily functions must be represented.

- Be Patient and Plan Ahead

- When selecting and implementing automation or new technologies, much of the work is done up front and must be thought through extensively.

With this larger context in place, you can then develop a plan to:

- Establish and enforce clear processes

- Choose appropriate technology

- Communicate effectively with your vendors

- Keep security top of mind

- Pay vendors with their preferred payment types

Old School AP vs. AP Automation in the Age of Digital Transformation

As mentioned, Accounts Payable has evolved over time. Recording data on stone tablets in cuneiform is the original old-school AP. Processes, recording platforms, and payment methods have come a long way from the ancient world.

However, some AP teams may feel they are still functioning in an archaic way – while you may not be using rocks, sticks and stones, the end-to-end process may include a lot of paper, repeatedly clicking buttons, or performing repetitive tasks for multiple entities.

Over the past decades, automation has snuck into back-office functions in small but not insignificant ways. You may rely on some of these solutions to streamline your processes:

- Printing electronic signatures instead of hand-signing check payments

- Using blank check stock instead of pre-printed stock

- Digital check archives instead of filing cabinets full of printed copies

If you’re paying vendors via check today and you’re NOT using these solutions, we highly suggest putting these in place to increase efficiency.

However, the future of AP and most financial functions point to a completely automated process. This includes invoice capture and management, workflow approvals, and electronic payments.

What’s your vision for how the Accounts Payable function could contribute to your organization and help it thrive in the big picture?

Accounts Payable Automation Benefits

- Save time: While there is plenty of up-front time cost when planning, a strong AP automation strategy ultimately saves staff hours of manual work.

- Save money

- Greater Control: Digital workflows and audit trails make it easier to enforce internal controls.

- Better Insight & Transparency

- Integrated systems:

- Capture Early Payment Discounts: When processes are automated, you’re more likely to be able to guarantee when payments go out the door. This enables you to negotiate with vendors for early pay discounts.

- Better Utilization of Personnel: When AP staff is freed from repetitive tasks like data entry, they can focus on more strategic initiatives.

To Outsource or Not to Outsource?

The word ‘outsource’ may have negative connotations in some minds. You may have a perception that outsourcing means sending sensitive financial information overseas, or that you will lose control or visibility into the invoice to payment lifecycle.

Outsourcing simply means you are employing a third-party organization to handle tasks or sub-tasks of the Accounts Payable process. Some of the most successful AP departments outsource specific parts of the AP function.

You may want to outsource tasks that are done on a daily or weekly basis to free up your personnel; or perhaps outsource tasks that are done less frequently but are important for compliance.

Examples of AP outsourcing:

- Invoice scan/capture

- Check printing/payments

- Unclaimed property tracking (escheatment)

- TIN Matching

- OFAC Screening

What are the Pros and Cons of Outsourcing AP Payments?

How to Measure AP Success

It’s important to measure the success of your accounts payable operations as part of your digital transformation efforts. Evaluating the efficiency, accuracy, and timeliness of the AP process will help prove whether your process improvements continue to bring value to the organization.

Consider the following key metrics:

- Payment turnaround: This refers to the time it takes for an invoice to be approved and paid. A shorter payment turnaround time indicates that efficiency is high and that invoices are being processed quickly.

- Payment accuracy: This refers to the percentage of invoices that are paid without errors. A high payment accuracy rate indicates that the accounts payable process is effective at preventing, catching, or fixing errors.

- Percentage of invoices paid on time: This refers to the percentage of invoices that are paid within the agreed upon payment terms. A high percentage of invoices paid on time indicates the company is meeting its payment obligations in a timely manner.

- Days payable outstanding (DPO): DPO is a financial metric that measures how long it takes for a company to pay its invoices. A lower DPO indicates your company is paying invoices in a timely manner.

- Vendor satisfaction: You’ll want to consider the satisfaction of your vendors, as a positive relationship has many benefits. Surveying suppliers to gauge their satisfaction with the accounts payable process can provide valuable insights into its effectiveness.

Overall, a successful accounts payable process is one that is efficient, accurate, and timely, and that maintains good relationships with suppliers. By tracking these key metrics, you can continually assess the success of your accounts payable process and identify areas for improvement.

How to Evaluate Accounts Payable Software

There are several factors to consider when evaluating accounts payable software:

- Functionality: Make sure that the software has all the features you need to manage your accounts payable process effectively. This may include invoice scanning and processing, vendor management, payment tracking, approval workflows, and audit trails/reporting tools.

- Integration: Consider how well the software integrates with other systems and tools you use, such as your accounting software, payroll system, and purchasing management system. Do you want your automation software to integrate within your ERP system fully or partially?

- Ease of use: Look for software that is user-friendly and easy to navigate, as this will make it easier for your team to adopt and use it effectively.

- Cost: Know the full cost, including upfront fees, recurring subscription costs, and ongoing charges related to maintaining custom import/export file transfers. Make sure the cost is justified by the value it provides.

- Security: Ensure the software has strong security measures in place to protect sensitive financial data, and to support internal controls like separation of duties.

- Customer support: Look for software that offers reliable customer care, including educational resources and technical support. You may want to ensure the software company can provide services like implementation and customizations, depending on your access to IT.

- Scalability: If your business is growing or expects to grow, make sure the software can scale with you.

It may also be helpful to test out the software before making a purchase, either through a free trial or a demo version. This will give you an opportunity to see how well it fits your needs and whether it is easy for your team to use.

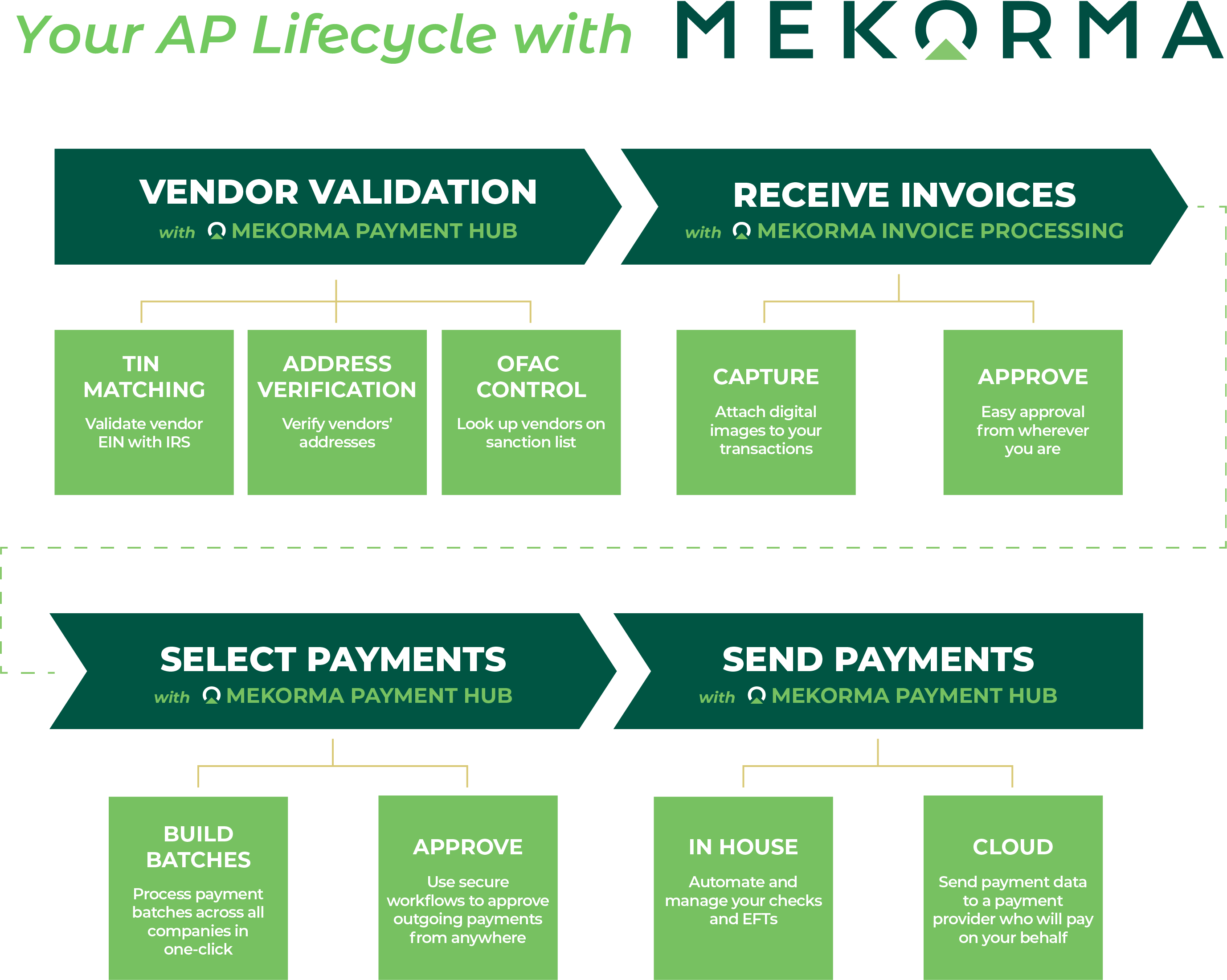

Mekorma’s AP Automation Software Suite for Microsoft Dynamics GP

End-to-end solution for Dynamics GP users

Mekorma offers AP automation software and solutions for Microsoft Dynamics GP users. From AI-powered invoice capture and entry to optimized/outsourced payments, Mekorma can help you streamline the entire accounts payable process.

Payment Hub for Microsoft Dynamics 365 Business Central

Streamline your vendor payments with Mekorma Payment Hub. From check printing features to integrating with a third-party provider, this solution embeds directly within your Business Central environment to ease common pains of AP.

Do you use Binary Stream’s Multi-Entity Management?

Get free trial of Mekorma Electronic Signatures for MEM

AP Risk Reduction for Acumatica

Reduce your company’s risk with AP automation tools for Acumatica Cloud ERP.

Electronic Signatures integrates with Acumatica’s approval workflow so you can print checks with automatic electronic signatures. No more hand-signing or stamping!

Vendor Validation provides integrated TIN matching and OFAC screening services - ensure compliance with current IRS and OFAC regulations and protect your company from fees or penalties.

Learn more about Vendor Validation tools

Case Study

Rio Marine, a company that handles a large volume of invoices each week, implemented Mekorma Power Approvals and the Mekorma Payment Hub's Action Board to streamline their payment process, allowing them to reduce their payment cycle by 75%.